New Jersey Corporate Tax Hike for Five Years, and No Sales Tax Increase

As New Jersey continues to address the Fiscal Year 2025 budget and the funds needed for the NJ Transit System, an increase to the state sales tax is not expected to be part of the budget deal. Instead, the state’s most profitable businesses are expected to pay higher taxes for the next five years to fund state transportation.

The preliminary agreement on the corporate tax rate, which is also expected to be applied retroactively, is part of a principal budget agreement between the State Speaker, Senate President, and Governor Phil Murphy. Other details are still being finalized on the proposed $56 billion spending plan for 2025.

An increase to the state sales tax was an idea floated this spring but knocked down by Assembly Speaker Craig Coughlin. That tax was cut from 7 percent to 6.625 percent under Gov. Chris Christie in a deal to raise the gas tax.

The tax rate on big businesses and sales taxes have been among the most contested parts of budget negotiations. The state’s business lobby strongly opposed increasing the corporate tax rate. At the end of 2023, the state let a 2.5 percent surcharge on corporations with profits over $1 million expire. However, during his FY2025 budget address, Murphy proposed keeping an additional 2.5 percent tax rate on corporations with over $10 million in profits.

It’s not immediately clear what the tax rate or profit threshold for businesses would be.

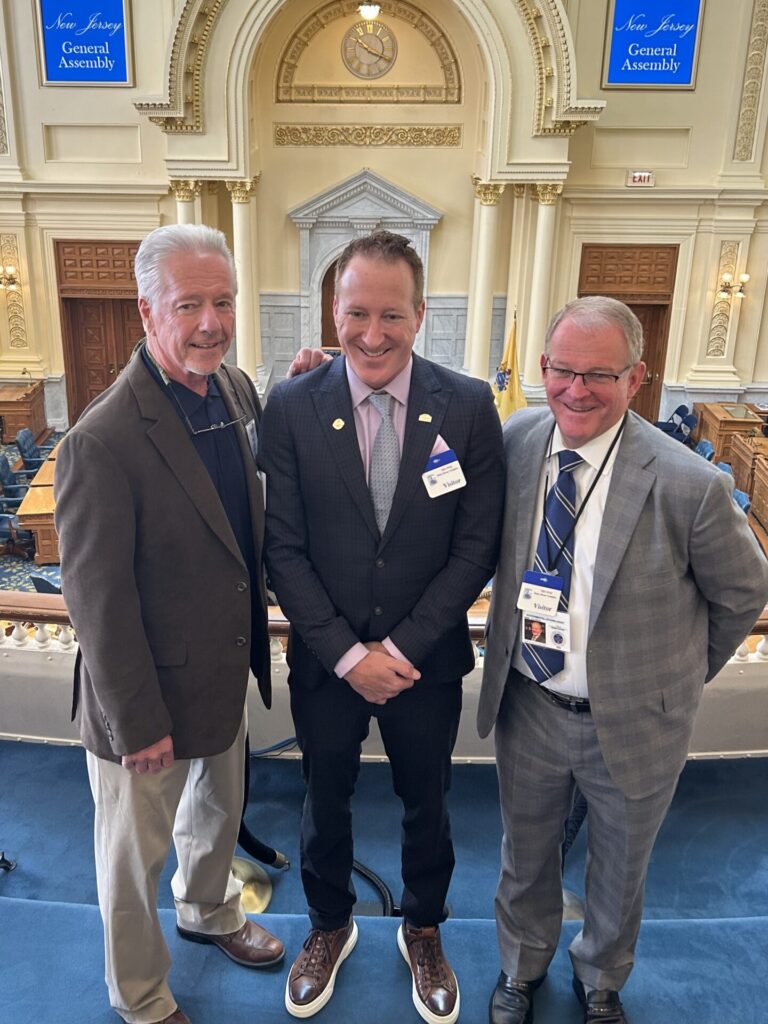

Lobby Day for NJ Building Materials Dealers Association Big Success

The NJ Building Materials Dealers Association, organized a day of legislative meetings last month in Trenton. Representatives of the NJBMDA and the Northeastern Retail Lumber Association met with legislators from around the state to discuss issues facing the industry and impacting small businesses. The discussion focused on the Corporate Business Tax, Property Taxes, and general topics impacting the cost of homes and small businesses in the State.